Content

- Waiting to save until after you’ve already spent your paycheck

- Are you planning to switch jobs soon? Here are 6 tips to help you prepare financially

- Use your credit card wisely

- Set a budget (or improve the one you have)

- How to Create a Budget that You Will Stick To

- #16: Know when fixed expenses may adjust

- Are some online vacation deals too good to be true?

Helpful tips to keep your spending in check and your finances on track. Of course, that also meant, for Mueller, studying the family’s finances and watching for any unexpected college fees and expenses that could catch Mueller off guard. The New Jersey mother said she had to adjust to living as a single mother of two on one income, so she decided to go on what she calls a “credit card fast.” Clean out your closet and any areas you may have belongings stored. Sell items and clothes you have no need for, and deposit the money into your savings. Look online for opportunities to sell used items and clothing, or use Facebook Marketplace.

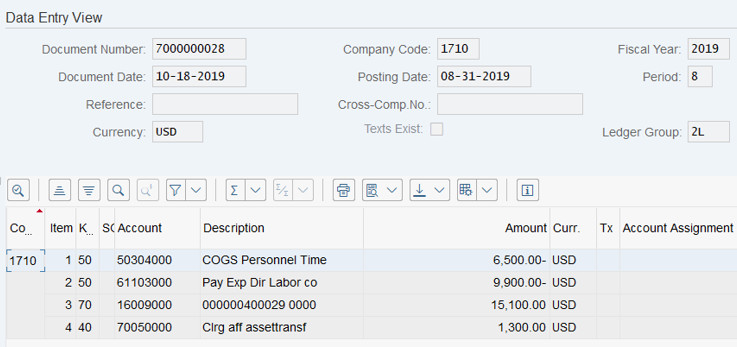

What are the 5 main expenses?

For most businesses, the five greatest expenses are: Staff, physical location, capital equipment, development costs, and Cost of Goods Sold (aka: Inventory).

We have 4 boys so planning and sticking on our budget is so important. I’ve never been good at sticking to a budget, but I think the point on tracking everything would be helpful. Already the impact of the pandemic has been vast and disorienting, and we don’t know what the economy or job market will look like in coming months. According to Fidelity’s Annual New Year Financial Resolutions Study, 32 percent of Americans are making financial New Year’s Resolutions this year.

Waiting to save until after you’ve already spent your paycheck

Calculate how much you are spending in each column, then look for places to cut costs. Most of your transactions and account information likely is readily available to you anytime in both your banking app and when you access your online banking account. You may even have a budgeting app linked to help you keep track of your expenses. So it may seem pointless or even redundant to keep track and balance your expenditures.

- Additionally, don’t forget things like birthday gifts, medical and dental out-of-pocket expenses, school supplies, and pet care, to name a few.

- If you think that you are a victim of smishing, you should contact law enforcement to report the scam.

- The bull market of the last decade seemed to make investing quite easy, large-cap growth dominated, and as long as you held the big-name tech stocks your portfolio, probably did well.

- Find money-building tips, insights and inspiration to help you improve your financial well-being at RCBbank.com/GetFit.

- From there, see how much money you have left over for wants and savings.

Without keeping track of your finances, does your money seem to disappear? Once you figure out why you want to start to budget, then you can figure out the best budget for you and most importantly be more likely to follow it. You will find that 48 Unexpected Expenses that will Bust Your Budgetand how to pay for them your budget will change as your why changes and this is perfectly ok! As circumstances and your priorities change, take the time to make the adjustments needed to your budget and you will be more likely to stick with it in the long run.

Are you planning to switch jobs soon? Here are 6 tips to help you prepare financially

Budgeting doesn’t have to be difficult or time consuming – especially if you avoid these budget don’ts so you can focus on what you need to do. As of September 2022, the average American carries $96,371 in debt, according to data from Experian. It’s become a norm for consumers to amass large amounts of debt and then bear the burden of attempting to pay it off slowly over time. Also, try making a shopping list before you go out to buy stuff. You can tailor the shopping list to ensure you get everything you need and stick within your budget. It might stop your eyes from wandering to other wants and serve as a reminder to not overspend.

- And if you’d like to pay it off early at some point in the future, contact your lender again to get an updated loan payoff amount.

- A yo-yo financing scam happens when a borrower agrees to a loan and signs a contract.

- If you don’t see any charges that are mentioned in the email, it’s very likely a scam.

- Having a budgeted list and sticking to it will help you navigate all the expenses that come with the holidays.

- But food costs can vary widely depending on how much you cook at home versus eating out.

Remember, you can only cut your spending so much, but your potential to earn is limitless. But part of https://online-accounting.net/ achieving all round better financial wellbeing is being able to tell when you’re on the wrong track.

Use your credit card wisely

By creating your sinking funds now, this can help you reach your financial goals faster and reduce money stress. Here’s how I like to track and include sinking funds in my monthly budget. This printable worksheet is included in my Budget Binder. Today I want to discuss everything you need to know about sinking funds and how you can start using them to prevent stress. What makes me qualified to assist others in reaching their financial goals? Because I’ve been building new products and businesses for large financial companies for longer than I’d like to admit! I’ve created mutual fund businesses, exchange-traded funds, and retirement plan products, to name a few.

Of course, you’ll want to tailor it to your own personal circumstances and goals. I recommend creating a separate line in your monthly budget, ideally under the “savings” section. For example, if you’re creating a sinking fund for Christmas, you may want to label it as “Christmas” or “Christmas Fund”.

Set a budget (or improve the one you have)

You should also revisit it anytime you take on a new recurring expense, such as a new streaming account or a magazine subscription. Unless you use a budgeting app that does the work automatically, getting stuck in checking spending totals every day or even every month can get exhausting. It’s the fastest way to ensure that you don’t keep up with your budget. When you do the check, look at 2-3 months from the period since the last time you checked in. Total up your spending for each month and compare it to the targets you set. If you are consistently overspending on a particular type of expense, you have a spending leak.

- University fees can quickly accumulate and often exceed $2,000 a year.

- The winter holidays are the most expensive time of year for almost every family.

- We plan our vacations around whether we have a pet sitter and how much the trip will cost.

- The upside of this type of loan is that you know the details of your permanent financing up front.

- It may seem like there’s a lot of hurry up and wait going on.

PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties.